Delivery Partner:

Business in the Community

| Curriculum Links: Health & Wellbeing, Numeracy & Mathematics, Social Studies |

Suitable Audience: P6, P7, S1, S2, S3, S4, S5, S6 |

Start/End Dates: September 2024 - June 2025 |

Timetable Availability: |

| Number of Sessions: 8 Primary / 4 Secondary (standalone) Sessions |

Session Duration: 45 Minutes |

Repetition Frequency: As often as required |

Max Capacity: Unlimited |

Description:

Developing young people’s core transferable skills gives them the tools to manage money, understand risk and build good financial habits throughout their life. Through LifeSkills sessions we introduce aspects of finance from an early age (primary) and encourage young people to explore mathematical concepts through real world examples. Financial education is important to help young people build their knowledge for future financial wellbeing.

DYW Context:

We recognise the challenges faced by young people leaving school with low aspirations and at risk of negative destination. Financial vulnerability, alongside the need to build a skilled workforce is an essential area of support Barclays LifeSkills can provide. We work with young people to give them the confidence, skills, and knowledge they need to succeed.

Primary - Session Info

The workshops aim to support primary learners with the knowledge and practical aspects related to good money management habits whilst developing core transferable skills. Our primary workshops are available as a series of four or standalone.

|

Term 3 |

||||

|

Workshop Date |

Time |

Day |

Month |

Workshop Content |

|

14/01/2025 |

9.30-10.15 |

Tuesday |

January |

Samir's Birthday Challenge |

|

21/01/2025 |

9.30-10.15 |

Tuesday |

January |

Introducing bank accounts and digital money |

|

28/01/2025 |

9.30-10.15 |

Tuesday |

January |

Planning how to spend money |

|

04/02/2025 |

9.30-10.15 |

Tuesday |

February |

Safe and Sensible Spending |

|

25/02/2025 |

9.30-10.15 |

Tuesday |

February |

Smarter shopping skills |

|

04/03/2025 |

9.30-10.15 |

Tuesday |

March |

Exploring Careers & Workplace Skills |

|

17/03/2025 |

1.30-2.15 |

Wednesday |

March |

Samir's Birthday Challenge |

|

26/03/2025 |

1.30-2.15 |

Wednesday |

March |

Introducing bank accounts and digital money |

|

Term 4 |

|

|

|

|

|

23/04/2025 |

1.30-2.15 |

Wednesday |

April |

Planning how to spend money |

|

30/04/2025 |

1.30-2.15 |

Wednesday |

April |

Safe and Sensible Spending |

|

14/05/2025 |

1.30-2.15 |

Wednesday |

May |

Smarter shopping skills |

|

21/05/2025 |

9.30-10.15 |

Wednesday |

May |

Introducing bank accounts and digital money (Numeracy Day) |

|

21/05/2025 |

1.30-2.15 |

Wednesday |

May |

Planning how to spend money (Numeracy Day) |

|

28/05/2025 |

1.30-2.15 |

Wednesday |

May |

Exploring Careers & Workplace Skills |

Secondary - Session Info

Our secondary workshops are available as a series of four or standalone and are offered on demand.

- Planning Budgets, Credit and Debt (Talk Money Week)

- Planning Budgets, Credit and Debt

- Calculating Salaries, Payslips, Student Loans and Pensions

- Calculating Salaries, Payslips, Student Loans and Pensions

- Exploring Insurance

- Protecting Against Online Fraud and Scams

There is no capacity limit on these sessions.

Certificate:

Your learners can receive their own certificate to their Glow email for attending this course. All they need to do is complete the feedback form. The certificate will include their name and the course they attended.

Registration

CLICK HERE TO REGISTER

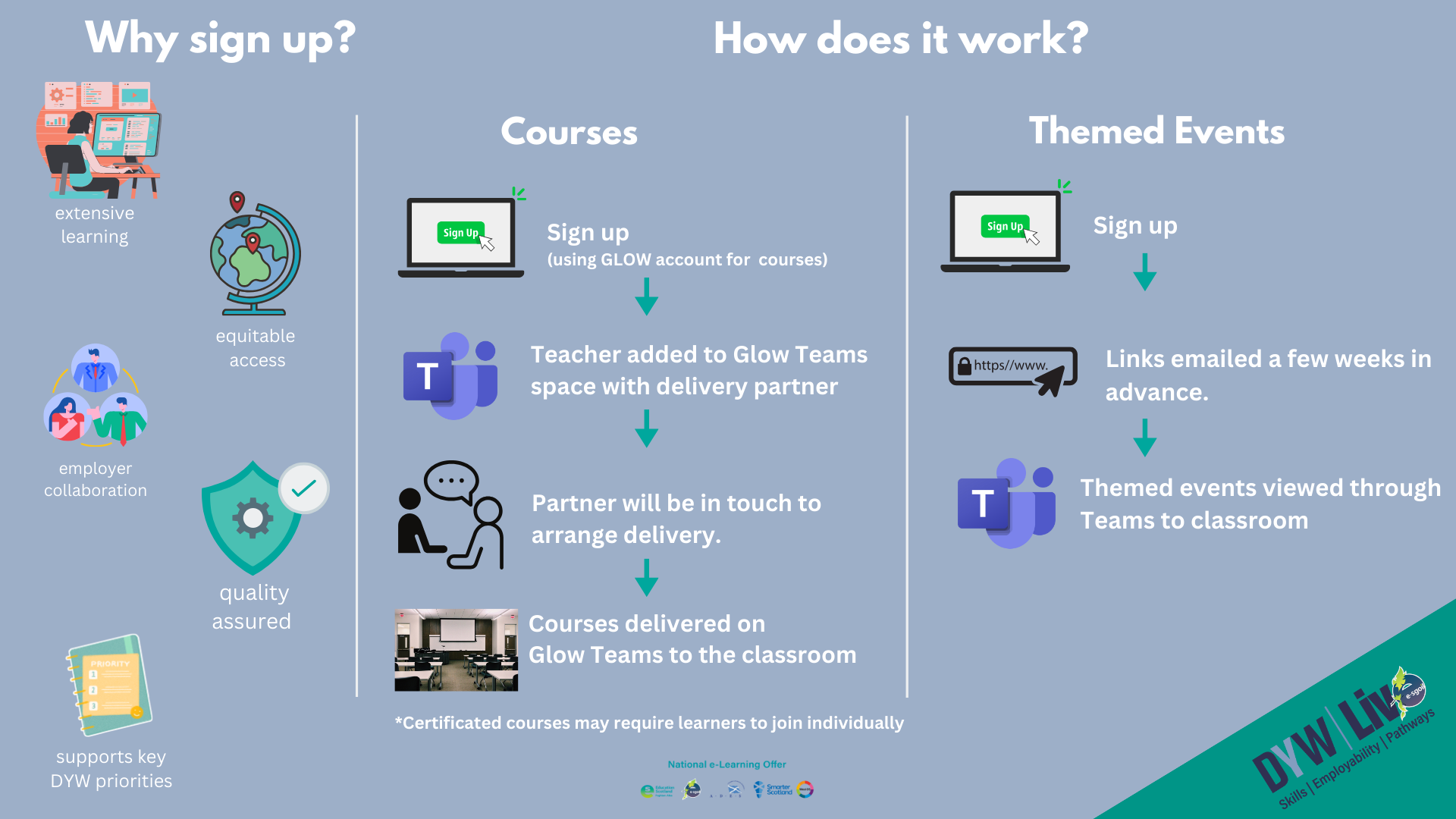

How DYW Live Works?: